The numbers are quite simply staggering both in terms of the challenge and the size of the potential reward. Around the world there are 2 billion ‘unbanked’ people – individuals without access to formal financial services.

There are also 200 million micro, small and mid-size businesses in growth markets that lack access to savings and credit, while those that do have access often pay high fees for a limited range of products.

Rural bank branch in Yerragudi village, Andhra Pradesh Source: Hindu Business Line

That, then, is the challenge. Now, the reward: delivering financial services to unbanked people in growth markets will add $3.7 trillion to the GDP of emerging economies within a decade, according to a recent report by McKinsey.

And the world is certainly moving in the right direction. The unbanked population shrank by 20% between 2011 and 2014 according to the World Bank, which has an ambitious goal for universal financial access by 2020.

What’s the problem?

So why is access to banking so important?

Lack of access to credit and savings facilities is a poverty trap. It holds both individuals and businesses back and stifles innovation. It greatly increases vulnerabilities to economic shocks and limits access to everything from healthcare to education. It is a strong force keeping the poorest people poor.

And women make up a disproportionately large share of the unbanked. For example, while 37% of women in growth economies have an account, 46% of men do. That gap is even bigger among those in poverty: women living below $2 a day are 28% less likely than men to have a bank account.

Bringing about financial inclusion takes a collaborative effort from the level of central banks, cooperating in mobile money systems, right through to micro-finance projects providing business loans to street vendors.

The Bill & Melinda Gates Foundation has a dedicated team looking at financial inclusion and digital innovation. Kosta Peric, the Gates Foundation’s deputy director of Financial Services for the Poor, told the International Business Times: “When I talk to banks, it’s a call to action, letting them know that financial inclusion can be a profitable business. It requires a different approach and a mix of new technologies, but has huge potential both on the country side and also for profit making private entities that are looking for new markets.”

As Melinda Gates says, “Financial tools for savings, insurance, payments, and credit are a vital need for poor people, especially women, and can help families and whole communities lift themselves out of poverty “.

Bank in a box

Tata Consultancy Services has been at the heart of extending financial inclusivity in India for many years. Through its ‘Bank in a Box’ banking system, it offers banking and financial services to the previously unbanked in rural, semi urban and urban areas.

The ability to access banking locally saves time and money spent travelling to branch centres and brings credit, savings and insurance services to unbanked areas for the first time.

TCS is working with more than a hundred banks in India to roll out the system, and has connected over 110 million people so far.

When TCS was chosen to implement the Financial Inclusion Solution (FIS) for Indian Bank, for example, the project was designed to reach over 3.5 million customers within the first three years of its life.

The system runs on remote, handheld devices using cloud-based technology. It delivers an easy-to-access and highly-secure environment, cost-effectively and efficiently.

TCS’s strategy has simplified the life of millions of people in remote locations. They can now receive their pension locally without any hassle, for example. It also provides employment opportunities for the individuals who manage the services locally.

The virtuous circle

Extending financial services has the potential to transform small business. For example, a street stall owner in India may only have a small sum of money to stock items week to week, making it impossible to purchase the extra supplies needed for festivals, during which demand is higher. As a result, the owner never has a chance to get ahead or to save extra money.

By providing small short-term loans, banks can offer business owners the financial support needed to make stock choices and other business decisions more effectively – and to make more money during periods of peak demand, rather than continuing to sell only what they can afford to purchase.

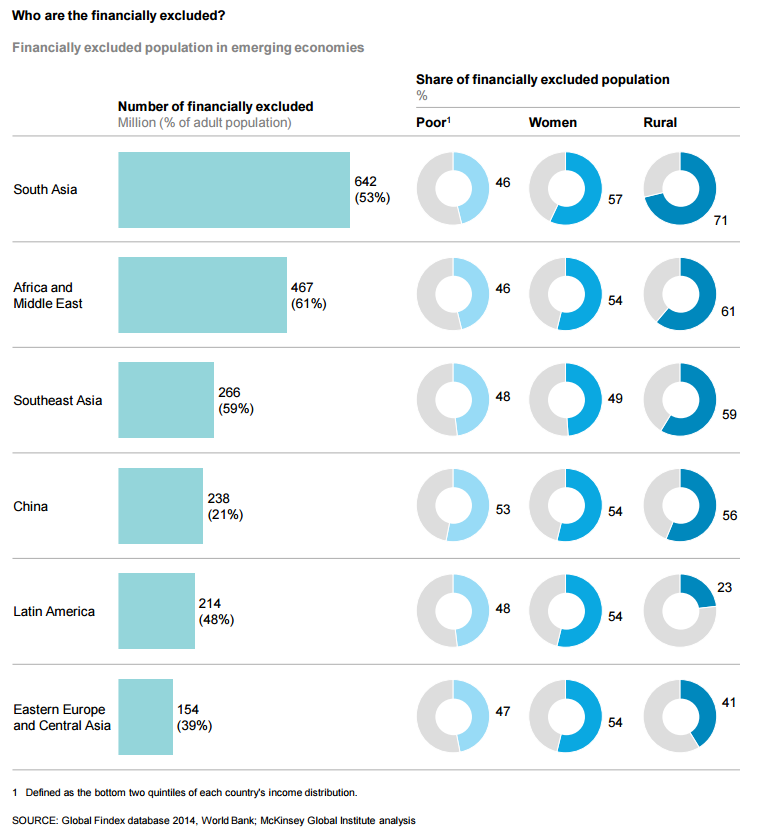

Source: McKinsey & Company

McKinsey’s report shows how millions of small loans can add up to a dramatic impact on the wider economy. It projects 95 million new jobs globally, $4.2 trillion in new deposits and a £3.7 trillion boost to GDP by 2025 – that‘s a 6% increase.

Banking is essential on every level. It makes sense for individuals looking for the increased freedom and empowerment it brings. It makes sense for businesses looking to expand. And it makes sense for governments looking to lift millions more people out of poverty.

The size of the challenge is undoubtedly great, with two billion people still facing financial exclusion. But with the growth of mobile phone ownership and the recognition that banking is an essential service for all, the number of unbanked citizens of the world is dropping, and dropping fast.